Inflation Is the Real Enemy

FOR CLIENTS

Amyr Rocha Lima, CFP®

11/11/20224 min read

2022 has been the year in which the old enemy of retirement income planning has reared its head!

According to the Office for National Statistics (ONS), UK inflation hit a 41-year high in October, accelerating to 11% due to rising energy and food prices.

What is inflation?

Inflation is a measure of the rate at which prices rise. For example, if something costs £1 and then rises to £1.02, the inflation rate for that item is 2%.

The ONS calculates inflation using a basket of goods and services that is constantly adjusted to reflect the population's spending habits. Hand sanitiser, for example, has now been added to the basket of goods, indicating that it has become a more popular item to purchase.

Why is high inflation so dangerous?

In financial planning in general, and particularly when it comes to retirement income planning, inflation is one of the biggest risks we face.

By using the Bank of England's inflation calculator, we can see that goods and services that cost £100 in 2012 now cost £131.38. And if we go back even further, to the last 30 years, that basket of goods and services that cost £100 in 1992 would now cost £201.59.

That's a significant increase in one's cost of living!

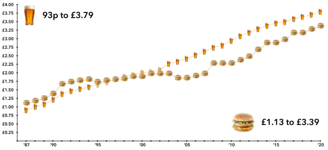

Let’s put this into a real life example. In 1992, a first class stamp cost 24p. Today a first class stamp costs 95p. This is an increase of 396%!

This gradual increase in the cost of living may be barely noticeable from year to year, but it can add up to significant amounts over time. If you don't have assets that keep up with inflation over a 30-year retirement, this can be disastrous.

What does this mean for you?

This means that having income streams and assets that can keep up with, or outperform, inflation should be a key component of your retirement income plan. The state pension and the majority of defined benefit pension schemes provide some inflation protection. But what about your ISAs, investment accounts and personal pension plans?

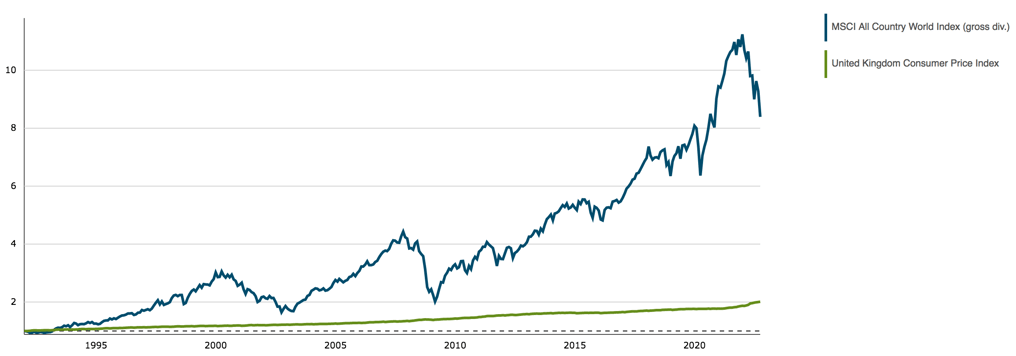

Historically, stock markets have done an excellent job of providing investors with returns that outperform inflation. Over the last 30 years, global stock markets have grown at an average annual rate of 9%, comfortably outperforming inflation. However, as you can see in the graph below, this is not without a fair share of volatility along the way.

SOURCE: ONS, The Economist, Humans Under Management

It's therefore also important to remember that assets that offer you a higher expected return imply higher degrees of volatility. And higher degrees of volatility can be risky if it leads you to misbehave with your investments. The greater your stock market exposure, the more vulnerable your assets are to stock market shocks, so you need to bear this in mind when building your financial plan.

To address this, look into combining a globally-diversified portfolio of stock market assets with more defensive, stable assets. Whilst this reduces the expected long-term return of the portfolio, it also reduces volatility, resulting in a portfolio that targets the inflation-beating growth that your financial plan requires - while also protecting your ability to sleep at night when markets are volatile.

The Bottom Line

A strategy for combating the effects of inflation is critical for the long-term success of your financial plan.

A holistic financial plan, looking at everything from your will to your pension, from inheritance planning to protecting your assets and the future of your family, could help you make the most of your money in the years ahead - both for yourself and for those those close to you.

With inflation at an all-time high, it's more important than ever to protect your wealth now and in the future. Don't wait any longer to discuss this with your financial planner, because it's possible that you'll need far more money than you think to plan for your financial future.

Amyr Rocha Lima, CFP® is a financial planner who specialises in working with successful professionals age 50+ to help them reduce taxes, invest smarter and retire on their terms.

“I worked with Amyr on my long-term retirement planning. No ask was too difficult, no question left without a very clear answer and often he identified further areas to explore, creating more work for himself and more value to me. The cherry on the cake was simply how pleasurable it was to work with him.”

Yossi Dahan

(Director, Microsoft)

*****

“I would like to wholeheartedly endorse my financial adviser, Amyr. You would have to go a long way to find a kinder, patient and more honest person. A truly nice guy who is a pleasure to deal with.”

Jeanette Edmiston

(Partner, Cushman & Wakefield)

*****

“We worked with Amyr over a number of months to build a financial plan as a basis to enter retirement. Amyr is very personable, approachable and has demonstrated throughout a depth of knowledge, experience and foresight supported by a clarity of communication to enable us to confidently enter this phase of our lives.”

Paul Toolan

(Programme Director, Xoserve)

*****

Here's what clients say

Let's chat

Ready to start building your financial plan?

Then you can book a free, no obligation call with me.

We'll have an initial conversation to better understand your requirements and to see whether my services would be a good fit.

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any financial products.

Copyright © 2024, Amyr Rocha Lima

Free Guide

Let's Connect

Chartered Financial Planner | Kingston upon Thames